BIR provides new guidelines in the claim of Input VAT on purchases or importations of capital goods by releasing RMC 21-2022

The Bureau of Internal Revenue (BIR) released this Revenue Memorandum Circular (RMC) to amend certain provisions of Section 110 of the Tax Code of 1997 while being in line with Section 35 of R.A (Republic Act). No. 10963 or “TRAIN Law”. The RMC stated how the Tax Code was implemented under section 4-110-3(c) of Revenue Regulations (RR) No. 13-2018 and emphasized a portion of the section which reads:

“Provide, further, That the amortization of the input VAT shall only be allowed until December 21, 2021, after which taxpayers with unutilized input VAT on capital goods purchased or imported shall be allowed to apply the same as scheduled until fully utilized:”

These new guidelines were prescribed by the BIR to help explain the new conditions on the claim of Input VAT on purchases or importations of capital goods. The RMC explains how BIR Forms Nos. 2550Q and 2550M which pertain to Quarterly Value-Added Tax (VAT) Declaration and Monthly VAT Declaration, respectively, are undergoing revisions to affect its provisions.

In response to the upcoming changes to these two BIR forms, the RMC presented two workaround procedures and guidelines:

BIR Form No. | Affected Fields | Description | Remarks |

2550M (v. February 2007)

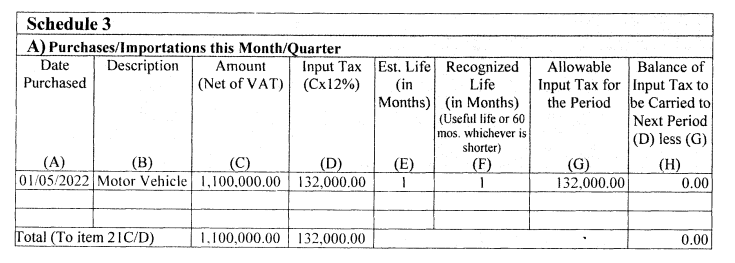

| Schedule 3(A) | Purchases/Importation of Capital Goods (Aggregate Amount Exceeds P1 Million) | Instead of the actual useful life in terms of months, place number “1” under columns “E” and “F” and encode the input tax claimed from the purchase of capital goods exceeding P 1M in Column “G” |

2550Q (v. February 2007)

| Schedule 3(A) | Purchases/Importation of Capital Goods (Aggregate Amount Exceeds P1 Million) | Instead of the actual useful life in terms of months, place number “1” under columns “E” and “F” and encode the input tax claimed from the purchase of capital goods exceeding P 1M in Column “G” |

The RMC also clarifies that the balance of input tax under EFPS and eBIR forms will be carried to the succeeding period and then automatically computed by these systems. It explains that for purposes of implementing the provisions of the Tax Code, as amended, effective January 1, 2022, all input tax on purchases of capital goods shall already be allowed upon purchase/payment and will no longer need to be deferred.

Taxpayers will have to indicate Roman Numeral “I” as the estimated useful and recognized useful life and encode the total input taxes claimed from purchase/s of capital goods exceeding P 1M under Column “G” to show a nil amount of “Balance of Input Tax to be carried to the next period under Column “H” of the monthly quarterly VAT returns.

Additionally, the RMC announced that taxpayers that have unutilized input VAT on capital goods purchased or imported prior to January l, 2022 shall be allowed to amortize the same as scheduled until fully utilized, requiring all to still fill out Schedule (B).

But it explained that if the depreciable capital good is sold/transferred within the period of live (5) years or prior to the exhaustion of the amortizable input tax, then the entire unamortized input tax on the capital goods sold/transferred is still claimable as input tax credit during the month quarter when the sale or transfer was made.

The RMC then provides an Illustration that was taken from Section 4-110-3(c) of RR No. l3-2018 to provide an easier reference for the taxpayers: