Payroll Wages in the Philippines: The basic ins and outs of managing employee payroll wages and employee benefits

Audit Firm Payroll Management Service provider shares a streamlined guide to computing Payroll wages in the Philippines.

The relationship between an employer and employee is meant to be mutually beneficial; the employee supplies the services advertised by the business to the clients, while the employer oversees the process and ensures that all is running as intended; even taking into consideration the changes to the economic environment to best adapt. This relationship allows employers to correctly manage and compute their employees’ wages and company-given benefits.

Payroll Management in the Philippines

Among the essential responsibilities an employer has to their employee is the act of withholding their worker’s taxes. The company must compute and correctly distribute its employee’s taxable income. The task may seem mundane at first, but the differences in the salary conditions regarding employee night shifts and even holiday paydays can significantly change the final salary.

As confusing as things get, employees fully expect their employers to handle these issues as efficiently as possible so that they can sustain their daily expenses. In such cases, outsourcing payroll requirements to a payroll outsourcing company like Mazars will reduce the monotony and workload needed to meet these requirements. Doubling as an accounting firm in the Philippines, firms like Mazars can help streamline the salary distribution process through their well-trained payroll managers. They can make relevant payments to government institutions and walk you through essential payroll requirements. This article lists the typical employer responsibilities, salary computations, and other payroll requirements for employers operating in the Philippines.

Understanding Philippine Payroll Wages

Knowing the salaries and employee benefits laws is essential when setting up a business in the Philippines. All the country’s employer-to-employee mandates are found in a presidential decree called The Labor Code of the Philippines, detailing all Payroll Salary Compensation and Benefits in the Philippines an employer must provide.

Employers need to consider that Philippine payroll cycles are monthly, making payments at least twice a month or once every two weeks, lasting no more than sixteen (16) days. The country also needs a thirteenth (13th) salary, equivalent to a month’s pay, required to be paid during or before 24th December.

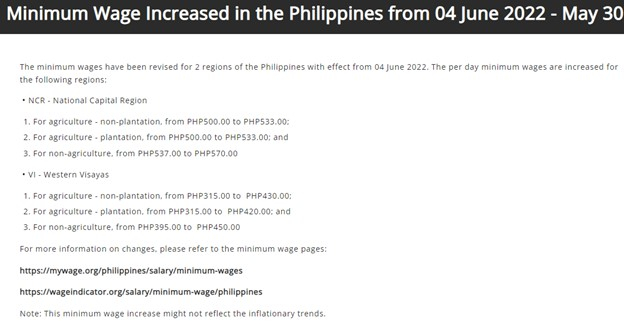

The minimum wage in the Philippines

The Philippines defines minimum wage as the lowest salary that can be legally given to an employee for their services; if an employer goes any lower, they will become liable for legal repercussions.

How to compute payroll’s taxable income in the Philippines

The Philippines defines taxable income as an employee’s overall gross income when certain adjustments are made to their salary. The most used tax income formula in the country is as follows:

Taxable Income = (Basic Salary + Additional Pay) – Deductions |

Additional pay can come from the added income from overtime, nightshifts, or holiday pays. At the same time, deductions are mandatory government contributions from agencies like the SSS or Philhealth and salary deductions from employee absences or if an employee has violated a company policy.

Holiday Pay in the Philippines

The Philippines mandates employee holiday pay: they must receive a regular daily wage even if they have not reported for work during a holiday. However, employees who show up for work during a holiday will receive an added holiday bonus to their salary, with rates depending on whether they worked on a regular holiday or a special holiday.

The holiday rates can be seen in the table below:

Type of Holiday | Bonus pay per hourly rate |

Regular Holiday | 200% of the daily rate |

Special Non-Working Holiday | 130% of the daily rate |

While workers will receive their usual rate on a regular holiday, the “no-work, no-pay” principle will be implemented for special holidays. Thus, employees who do not report for work on a special holiday will receive no payment. But employers can still pay their employees’ daily rate on a special holiday if they want to, but this is not mandatory.

Proclamation No. 368, released on October 11, 2023, declared ten (10) working holidays, followed by eight (8) special (non-working) days. Certain changes were added to the holiday list, these included removing the EDSA People Power Revolution Anniversary but adding the Chinese New Year and Christmas Eve as non-working holidays.

The list of all holidays for the year of 2024 are as follows:

Regular Holidays

DATE | Holiday |

January 1, 2024 | New Year’s Day |

March 28, 2024 | Maundy Thursday |

March 29, 2024 | Good Friday |

April 9, 2024 | Araw ng Kagitingan |

May 1, 2024 | Labor Day |

June 12, 2024 | Independence Day |

August 26, 2024 | National Heroes Day (Last Monday of August) |

November 30 , 2024 | Bonifacio Day |

December 25, 2024 | Christmas Day |

December 30, 2024 | Rizal Day |

SPECIAL (NON-WORKING) DAYS

DATE | Holiday |

August 21, 2024 | Ninoy Aquino Day |

November 1, 2024 | All Saints’ Day |

December 8, 2024 | Feast of the Immaculate Conception of Mary |

December 31, 2024 | Last Day of the Year |

ADDITIONAL SPECIAL (NON-WORKING) DAYS

DATE | Holiday |

February 10, 2024 | Chinese New Year |

March 30, 2024 | Black Saturday |

November 2, 2024 | All Souls' Day |

December 24, 2024 | Christmas Eve |

Overtime and Nightshift wage rates in the Philippines

The Philippines mandate that working hours must not exceed eight hours (8) daily; note that this does not include the mandatory one-hour lunch break. Once an employee goes over eight hours, overtime wages must be paid. They also need to consider the night shift differential rate, which will apply when an employee must work between 10:00 pm and 6:00 am. The overtime and night shift rates depend on an employee’s hourly rate.

The overtime rates and night-shift rates in the Philippines are as follows:

Type of Overtime | Hourly Rate |

Overtime during regular working hours | 125% |

Overtime during a rest day | 130% |

Night Shift rate | 110% |

Employees can use overtime or do a night shift during holidays; if they do so, the rate of their bonuses must be stacked.

Philippine Salary Deductions

Employers can add deductions to an employee’s salary if they do not adhere to company policies or standards, such as arriving late or leaving work early. Deductions to their salary can also be made if they have taken unpaid leaves. Additional causes for deduction include company-specific policies, such as if an employee is given car or housing loans from the company, healthcare plans, or other dues.

Government-Mandated Contributions

The Philippines requires employees to make mandatory government contributions in income tax rates that will be shared with the employer. The table below lists these contributions:

1) Social Security System (SSS) – Any contributions made to the SSS depends on the employee’s salary. But employers must consider the fixed ceiling amount for employees with a monthly salary of 20,250 pesos or more. Employers must pay for their share of the employee’s SSS contributions.

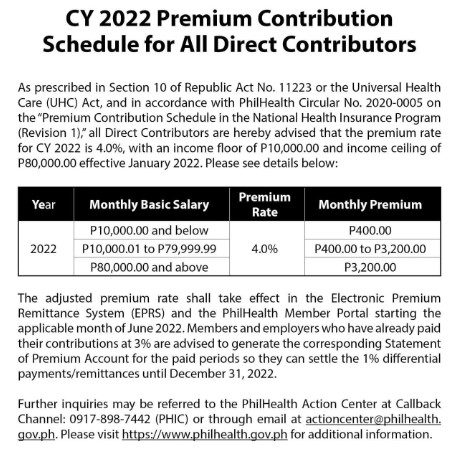

2) Philippine Health Insurance Corporation (PhilHealth) – The PhilHealth organisation gives employees a national health insurance program all over the Philippines.

3.) Home Development Mutual Fund (Pag-IBIG) – The Pag-IBIG fund handles the country's national savings program and gives working individuals loans and housing programs. Employers and employees must pay PHP 100 per month to utilise PAG-IBIG’s services.

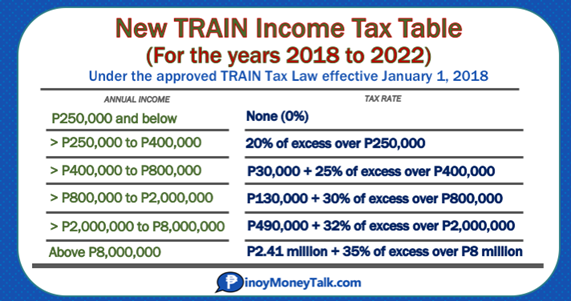

Computing for payroll taxes in the Philippines

The law explains that the tax rate scales with an employee’s taxable income, meaning that the higher the taxable income, the higher the tax rate. However, employees with PHP 250,000 or less annual wages are exempt from this tax. Additionally, employers can deduct taxes from employees monthly or semi-monthly.

The following table explains the tax rates in the Philippines:

Annual Taxable Income | Tax Rate |

Equal or less than PHP 250,000 | 0% |

Over 250,000 – up to 400,000 | 20% of the excess over 250,000 |

Over 400,000 – up to 800,00 | PHP 30,000 + 25% of the excess over PHP 400,000 |

Over 800,000 – up to 2,000,000 | PHP 130,000 + 30% of the excess over PHP 800,000 |

Over 2,000,000 – up to 8,000,00 | PHP 490,000 + 32% in excess over PHP 2,000,000 |

Equal to and over 8,000,000 PHP | PHP 2.41 million + 5% of the excess over 8 million PHP |

The benefits offered by De Minimis in the Philippines

De minis are defined as an added small value compensation provided by an employer other than a basic salary; these are considered non-taxable.

The available De Minimis benefits offered in the country are:

- Laundry allowance – Reaches up to PHP 300 (approx. USD 6) per month.

- Medical benefits – Reaches up to PHP 10,000 (approx. USD 200) annually.

- Gifts – These count as presents offered during Christmas, festivals, or significant circumstances during an employee’s life; these include events such as marriage or a death in the family. Up to PHP 5,000 (approx. USD 100) per year.

- Employee achievement awards can arrive in forms besides cash or gift vouchers, which can go up to PHP 10,000 (approx. USD 200) per year.

- Meal allowance – is given during overtime work, which can go up to 25% of the bare minimum wage.

- Unused leave credits converted to cash. Maximum of 10 days per year.

- Rice subsidy – Reaches up to PHP 1,500 (approx. USD 30) per year.

- Medical cash allowance – Reaches up to PHP 750 (approx. USD 15) per semester or PHP 125 (USD 2.50) per month.

- Uniform and clothing allowance – Can go up to PHP 5,000 (approx. USD 100) per year.

Employers have the option to create a pay structure that utilises the full benefits of the de minimis so that the amount of taxes paid can be minimised. While this may seem practical, you must consider the time and resources used to compute and document the benefits concerning the perceived costs saved. A payroll company like Mazars can provide you with payroll consultants to help you organise these wages so you can correctly distribute them to your employees.

The 13th Month Pay in the Philippines

The Labor Code says that all employees working for their company for over one month are entitled to the thirteenth (13th) month’s pay. They must be given their 13th-month income no later than December 24 of each year, equivalent to PHP 90,000. Additionally, it is considered non-taxable.

The computations show that the 13th-month pay amounts to an employee’s total basic salary divided by 12. If the employee has been employed in the company for less than a year, they need to be given an amount relevant to their period of employment. This distributed amount also applies to employees leaving the company before the end of the year.

Please note that job applicants are not commonly given the 13th-month salary since it is not part of their contracts.

Payroll services and management with Mazars

Distributing each employee’s salary can take a strenuous amount of energy, time, and effort, which your company could have utilised. Make payroll processes much easier by using the services of a trusted payroll outsourcing company. Mazars computes special rates, payroll wages, income taxes, and contributions. Other benefits include dealing with employee payments and mandatory requirements from government institutions.