Due Process Requirement in the Issuance of a Deficiency Tax Assessment

Mazars' Tax Manager, Carl Franz S. Dela Riva, shares the due process requirements in the issuance of a deficiency tax assessment pursuant to C.T.A. EB CASE NO. 2352, RR No. 18-2013, and RR No. 22-2020

During this time in which the BIR is aggressive in handing out Letters of Authority left and right, it is important for taxpayers to know the due process when it comes to such deficiency tax assessments for them to avail the remedies provided by the law. The CTA EB case illustrated here clarifies the one hundred eighty (180)-day period referred to in Section 228 of the Tax Code.

Last January 9, 2023, in C.T.A. EB CASE NO. 2352, Commissioner of Internal Revenue, vs. Ruben U. Yu, the Court En Banc has emphasized that the 180-day period referred to in Section 228 of the Tax Code, as amended, and in Section 2.1.4 of Revenue Regulations (RR) No. 12-99, as amended by RR No. 18-2013, is confined only to the period within which either the Commissioner of Internal Revenue (CIR) or his/her duly authorized representative may act on the initial protest against the Final Assessment Notice (FAN)/Formal Letter of Demand (FLD).

Thus, if a taxpayer files an administrative appeal to request the reconsideration of the decision of the CIR's duly authorized representative on a protest, the CIR is not given a fresh or separate 180-day period to decide on the administrative appeal.

The following are the relevant dates noted in the case:

Date | No. of Days | Remarks |

December 3, 2015 | The taxpayer filed a protest and requested a reinvestigation | |

February 1, 2016 | 60 | 60 days from December 3, 2015, to submit the required supporting documents |

July 30, 2016 | 180 | 180 days from February 1, 2016, for the CIR's duly authorised representative to act on the taxpayer's protest |

August 22, 2016 | 23 | The RD issued a revised tax assessment, demanding the immediate payment of the taxpayer's deficiency taxes |

September 20, 2016 | 29 | Taxpayer filed an administrative appeal with the CIR |

April 17, 2017 | 209 | The taxpayer filed a petition for review with the CTA in view of the CIR's inaction on the administrative appeal |

The taxpayer was under the impression that the CIR had a fresh or separate 180-day period to act on the administrative appeal. The taxpayer filed his petition for review with the CTA within 30 days from the lapse of the 180-day period.

Decision of the CTA en banc:

The pertinent portion of RR No. 12-99, as amended by RR No. 18-2013, is clear that the 180-day period is counted from the date of the filing of the protest, and not from the filing of the administrative appeal, to wit:

- "If the protest or administrative appeal is not acted upon by the Commissioner within one hundred eighty (180) days counted from the date of filing of the protest, the taxpayer may either: (i) appeal to the CTA within thirty (30) days from after [sic ] the expiration of the one hundred eighty (180)-day period; or (ii) await the final decision of the Commissioner on the disputed assessment and appeal such final decision to the CTA within thirty (30) days after the receipt of a copy of such decision.

Thus, it is apparent that instead of appealing the case to the Court in Division within 30 days after the expiration of the 180-day for the protest to be acted upon by the Commissioner's duly authorized representative, respondent opted to wait for the Commissioner's duly authorized representative’s final decision. The relevant portion of RR No. 12-99, as amended by RR No. 18-2013, provides:

- "If the protest is not acted upon by the Commissioner's duly authorized representative within one hundred eighty (180) days counted from the date of filing of the protest in case of a request reconsideration [sic ]; or from date of submission by the taxpayer of the required documents within sixty (60) days from the date of filing of the protest in case of a request for reinvestigation, the taxpayer may either: (i) appeal to the CTA within thirty (30) days after the expiration of the one hundred eighty (180)-day period; or (ii) await the final decision of the Commissioner's duly authorized representative on the disputed assessment."

As such, when respondent filed a request for reconsideration with petitioner on September 20, 2016, the 180-day period had already lapsed on July 30, 2016 for petitioner to act on the request for reconsideration/administrative appeal. The CTA ruled that since the 180+30-day period had already lapsed, the petition for review has already prescribed. The only option left for the taxpayer is to wait for the CIR’s decision before filing to the CTA within 30 days from receipt of the CIR’s decision.

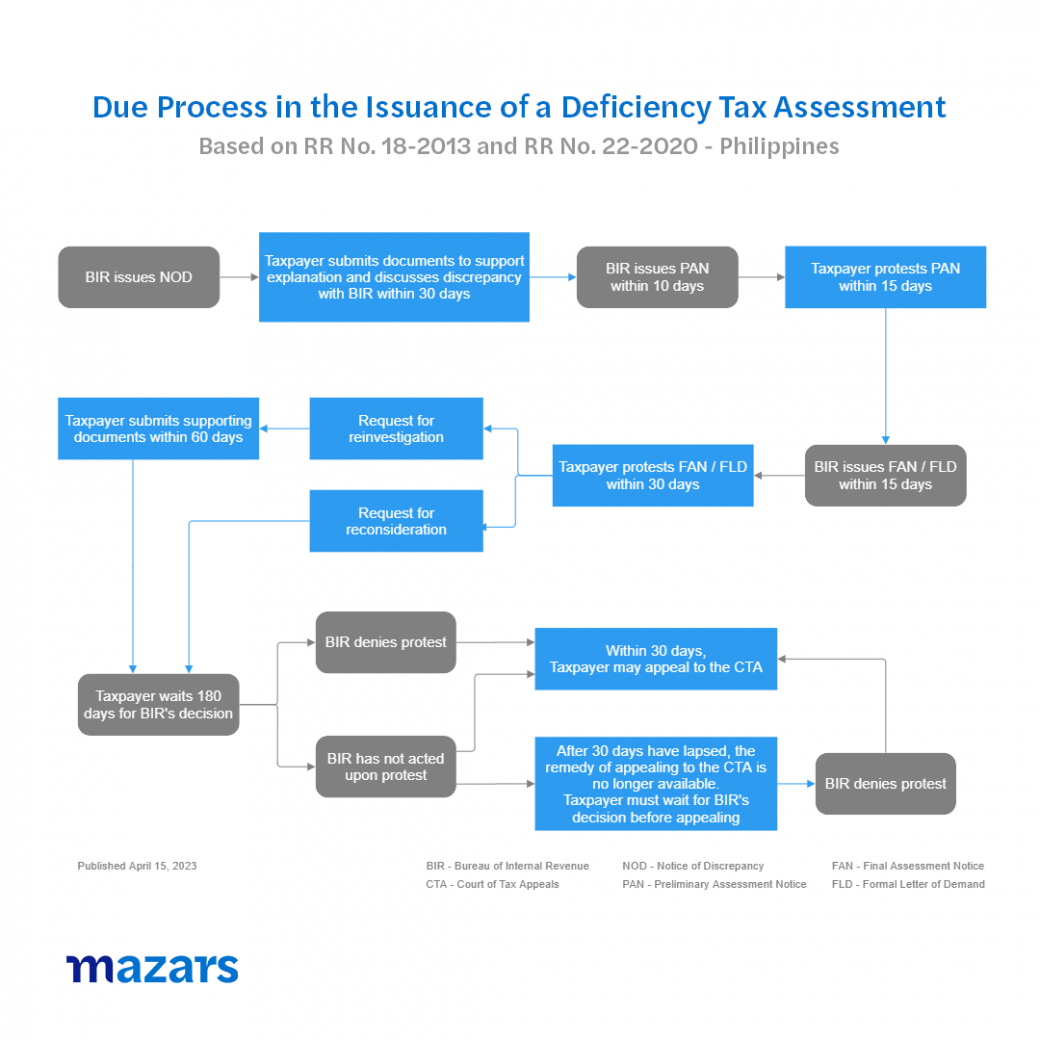

As reference to taxpayers, the following illustration represents the due process in the issuance of a deficiency tax assessment provided in RR No. 18-2013 and RR No. 22-2020:

Carl Franz S. Dela Riva is a Manager from the Tax Group of Yu Villar Tadeja & Co. (Mazars Philippines, Inc.). This article is for general information purposes only and should not be considered as professional advice to a specific issue or entity. The views and opinions expressed herein are those of the author and do not necessarily represent Yu Villar Tadeja & Co. (Mazars Philippines, Inc.).