Withholding Taxes: A comprehensive guide to Understanding and Navigating Transactions subjected to Withholding.

Mazars' Tax Associate, Mary Ann Dela Cruz, shares this guide on the essential things to know about Withholding Taxes and Transactions subjected to Withholding in the Philippines.

One of the common challenges a taxpayer is experiencing is whether a certain transaction is subject to withholding or not.

Withholding taxes are a system of tax collection in which the tax amount is withheld or deducted at the source of income by the payer or withholding agents. The tax withheld is directly remitted to the government on behalf of the taxpayers.

There are different types of withholding taxes for corporations and individuals in the Philippines — namely, the Final Withholding Tax, Expanded Withholding Tax, and Withholding Tax on Compensation.

Final Withholding Tax is the final tax withheld from payments to nonresident foreign corporations (NRFCs) and taxes on passive income payments. Certificate of Final Tax Withheld At Source (BIR Form 2306) is a certificate to be accomplished and issued by a Payor/Withholding Agent to each recipient of income subjected to final tax. The amount of payment column should indicate the total amount paid and the total taxes withheld and remitted during the period.

Expanded Withholding Tax is a tax prescribed on income payments and is creditable against the payor’s income tax due. Alongside this is the issuance of the Certificate of Creditable Tax Withheld At Source (BIR Form 2307) to the payor/income recipient which represents the amount of tax withheld from the income payment. It is a certificate to be issued by the withholding agent (customer) to its supplier as an income tax credit, showing therein the monthly breakdown of the total income payments made and the total taxes withheld and remitted during the quarter/period.

Withholding Tax on Compensation deducts and withholds taxes from employees receiving compensation income from its employers. Certificate of Compensation Payment/Tax Withheld for Compensation Payment with or Without Tax Withheld (BIR Form 2316) is issued to each employee receiving salaries, wages and other forms of remuneration by each employer indicating therein the total amount paid and the taxes withheld therefrom during the calendar year.

This article will focus primarily on discussing the transactions related to Expanded and Final withholding taxes that are applicable to transactions involving suppliers and customers as well as payors and payees.

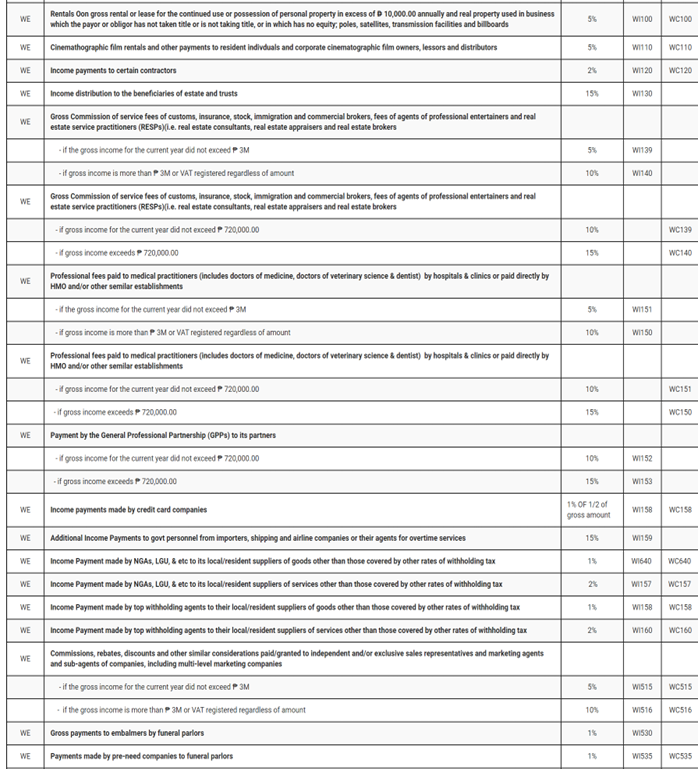

Final Withholding Tax

Under Section 2 of Revenue Regulation 11-2018 The following forms of income shall be subject to final withholding tax at the rates herein specified:

- Interest Income

- Interest from any peso bank deposit, and yield or any monetary benefit from deposit substitutes and from trust funds and similar arrangements; royalties, prizes (except prizes amounting to Ten thousand pesos [₱10,000] and other winnings (except winnings from Philippine Charity Sweepstakes and lotto amounting to ₱10,000 or less which shall be exempt) derived from sources within the Philippines – subject to “20%” FWT.

- Interest income received by an individual taxpayer from a depository bank under the Expanded Foreign Currency Deposit system – subject to “15%” FWT.

- Cash and/or property dividends actually or constructively received from a domestic corporation, joint stock company, insurance or mutual fund companies and regional operating headquarters of multinational companies, or on the share of an individual in the distributable net income after tax of a partnership (except general professional partnership) of which he is a partner, or on the share of an individual in the net income after tax of an association, a joint account or a joint venture or consortium taxable as a corporation of which he is a member or co-venturer – subject to “10%” FWT.

- Capital Gains from Sale of Shares of Stock Not Traded in the Stock Exchange. – On net capital gains realized during the taxable year from the sale, barter, exchange, or other disposition of shares of stock in a domestic corporation – subject to “15%” FWT.

Generally, corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents, generally at the rate of 25% in the case of payments to non-resident foreign corporations and for non-resident aliens not engaged in trade or business. As stated in the Section 23(F) of the National Internal Revenue Code (NIRC), NRFC is only taxable from those income derived from the Philippines hence in order for the payment to NFRC, the transaction must be performed within the Philippines. Otherwise, the income payment to the NRFC will not be subject to FWT.

To classify as an Exemption the taxpayer must provide the following documentation such as:

- Negative Certification issued by the Philippine Securities and Exchange Commission (SEC)

- Service agreement/billing expressly stating that services were rendered outside the Philippines.

In case of tax audit, the taxpayer must be ready to present the above documentation to the BIR to prove that the transaction is tax-exempt.

Expanded Withholding Tax

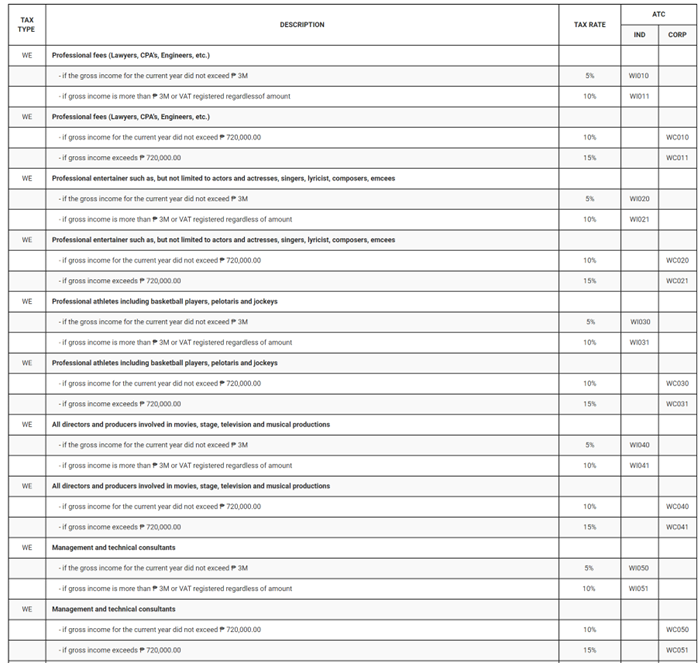

For the Expanded Withholding Tax (EWT) under the Sec 2 of Revenue Regulation (RR) No. 11-2018 (Amended RR 2-98) the BIR enumerates the income payments subject to Expanded Withholding Tax and the rates prescribes thereon as follows:

- PROFESSIONAL FEE (Lawyers, CPA's, Engineers, etc.)

- Those individually engaged in the practice of profession or callings; lawyers; certified public accountants; doctors of medicine; architects; civil, electrical, chemical, mechanical, structural, industrial, mining, sanitary, metallurgical and geodetic engineers; marine surveyors; doctors of veterinary science; dentist; professional appraisers; connoisseurs of tobacco; actuaries; interior decorators, designers, real estate service practitioners (RESP), (i.e. real estate consultants, real estate appraisers and real estate brokers) and all other profession requiring government licensure examination regulated by the Professional Regulations Commission, Supreme Court, etc.

- For Individual:

- if the gross income for the current year did not exceed P 3M – subject to “5%” EWT.

- if gross income is more than P 3M or VAT registered regardless of amount - subject to “10%” EWT

- For Corporation

- if the gross income for the current year did not exceed P 720,000.00 – subject to “10%” EWT.

- if gross income exceeds P 720,000.00 – subject to “15%” EWT.

- Management and Technical Consultant

- Entities engaged to supervise, direct and control the management and operation of other companies, and normally render services to various unrelated parties.

- Business and Bookkeeping agents and agencies

- For Individual:

- if the gross income for the current year did not exceed P 3M – subject to “5%” EWT.

- if gross income is more than P 3M or VAT registered regardless of amount - subject to “10%” EWT

- For Corporation

- if the gross income for the current year did not exceed P 720,000.00 – subject to “10%” EWT.

- if gross income exceeds P 720,000.00 – subject to “15%” EWT.

- For Individual:

- Fees of Director who are not employees of the company.

- whose duties are confined to attendance at and participation in the meetings of the board of directors.

- if the gross income for the current year did not exceed P 3M – subject to “5%” EWT.

- if gross income is more than P 3M or VAT registered regardless of amount - subject to “10%”

- whose duties are confined to attendance at and participation in the meetings of the board of directors.

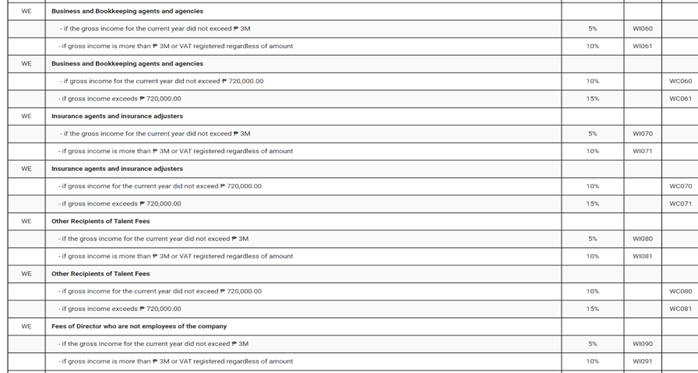

- RENTALS

- Real Properties - On gross rental for the continued use or possession of real property used in business which the payor or obligor has not taken or is not taking title, or in which he has no equity – subject to “5%” EWT.

- Personal Properties – On gross rental or lease in excess of Ten Thousand Pesos (₱10,000) annually for the continued use or possession of personal property used in business which the payor or obligor has not taken or is not taking title, or in which he has no equity, except those under financial lease arrangements with leasing and finance companies authorized to operate under Republic Act No. 8556 (Financing Company Act of 1998). – subject to “5%” EWT

- CONTRACTORS – subject to “2” EWT

- General engineering contractors — Those whose principal contracting business in connection with fixed works requiring specialized engineering knowledge and skill.

- General Building contractors — Those whose principal contracting business is in connection with any structure built, for the support, shelter and enclosure of persons, animals, chattels, or movable property of any kind, requiring in its construction the use of more than two unrelated building trades or crafts, or to do or superintend the whole or any part thereto

- Specialty Contractors — Those whose operations pertain to the performance of construction work requiring special skill and whose principal contracting business involves the use of specialized building trades or crafts.

- Other contractors —

- Filling, demolition and salvage work contractors and operators of mine drilling apparatus;

- Operators of dockyards;

- Persons engaged in the installation of water system, and gas or electric light, heat or power;

- Operators of stevedoring, warehousing or forwarding establishments;

- Transportation contractors which include common carriers for the carriage of goods and merchandise of whatever kind by land, air or water

- Printers, bookbinders, lithographers and publishers

- Messengerial, janitorial, private detective and/or security agencies, credit and/or collection agencies and other business agencies;

- Advertising agencies, exclusive of gross payments to media;

- Independent producers of television, radio and stage performances or shows;

- Independent producers of “jingles”;

- Labor recruiting agencies and/or “labor-only” contractors.

- Persons engaged in the installation of elevators, central air conditioning units, computer machines and other equipment and machineries and the maintenance services thereon

- Persons engaged in the sale of computer services, computer programmers, software/program developer/designer, internet service providers, web page designing, computer data processing, conversion or base services and other computer related activities;

- Persons engaged in landscaping services;

- Persons engaged in the collection and disposal of garbage;

- TV and radio station operators on sale of TV and radio airtime; and

- TV and radio blocktimers on sale of TV and radio commercial spots

- Credit Card Companies

- On one-half (1/2) of the gross amounts paid by any credit card company in the Philippines to any business entity, whether a natural or juridical person, representing the sales of goods/services made by the aforesaid business entity to cardholders.

- For Individual and Corporation – subject to 1% of ½ of gross amount

- On one-half (1/2) of the gross amounts paid by any credit card company in the Philippines to any business entity, whether a natural or juridical person, representing the sales of goods/services made by the aforesaid business entity to cardholders.

Transactions that will be subjected to these withholding taxes will depend on whether an Individual or Corporation is a Top Withholding Agent (TWA) or not. The Bureau of Internal Revenue (BIR) redefined the criteria for top withholding agents (TWAs) when it released Revenue Regulations (RR) No. 7-2019 on June 13, 2019. TWAs shall now refer to taxpayers whose gross sales/receipts, gross purchases, or claimed deductible itemized expenses amounted to P12 million during the preceding taxable year.

Revenue Regulations (RR) No. 31-2020, issued on December 18, 2020, amends the criteria for identifying the Top Withholding Agents as provided by Section 2 of RR No. 11-2018, (as previously amended by RR No. 7-2019).

Previously, RR No. 7-2019 provided that top withholding agents shall refer to those taxpayers whose gross sales/receipts or gross purchases or claimed deductible itemized expenses amounted to P12,000,000 during the preceding taxable year.

However, with RR No. 31-2020, “top withholding agents” shall now refer to those taxpayers whose gross sales/receipts or gross purchases during the preceding taxable year shall fall under the following minimum thresholds:

RDO Group Classification | Gross Sales/Receipts or Gross Purchases |

Groups A and B | At least P12,000,000 |

Groups C, D, and E | At least P5,000,000 |

Under the Revenue Regulation, the BIR is required to serve notice by publishing the list of TWAs in a newspaper of general circulation or to post it on the BIR website. After being notified, the obligation of the TWAs to withhold 1% and 2% EWT shall commence on the first day of the month following the month of publication. This rule shall apply to all TWAs except those already classified as TWAs under RR No. 11-2018 including the Top 20,000 private corporations identified in previous regulations. The list on Top Withholding Agent will be found at the BIR website thru this link “Top Withholding Agents – Bureau of Internal Revenue (bir.gov.ph)”.

Top Withholding Agents (TWAs) are required to withhold 1% and 2% EWT on their local/resident suppliers of goods and services, respectively, if the local purchases are not covered by the other EWT rates. Basically, all expenses of a TWA are subject to withholding tax, except those paid through company-issued credit cards and payments to entities such as general professional partnerships, cooperatives, business/civic leagues, and entities that are exempt from income tax or under income tax holiday. The term “goods” pertains to tangible personal property; it excludes intangible personal property, as well as agricultural products which are defined under Section 2 of RR No. 2-1998. Further, the term “local resident suppliers of goods/services” pertains to a supplier from whom the TWA regularly purchases goods/services. Regular supplier means to whom the taxpayer has transacted at least six times, regardless of the amount per transaction. As a general rule, this term does not include a casual purchase of goods/services, i.e., purchase made from a non-regular supplier and oftentimes involving a single purchase. However, a single purchase which involves P10,000 or more shall be subject to withholding tax.

Pursuant to Revenue Memorandum Circular No. 8-2014, withholding agents shall also require entities claiming exemption to provide a copy of a valid, current, and subsisting tax exemption or ruling which must explicitly recognize the grant of tax exemption, as well as the corresponding exemption from withholding tax.

In conclusion understanding the nature of transactions subject to withholding taxes may be crucial and burdensome but they serve an essential purpose in revenue collection and regulation. By staying informed and seeking professional advice, taxpayers can mitigate tax liabilities and possible tax exposure during the tax audits of the BIR.

To further understand all the transactions subject to Final Withholding and Expanded Withholding Taxes, please refer to the attached Tables for the summarizes detailed transactions.

For Expanded Withholding Tax

For Final Withholding Tax